Using DMI

The primary objective of the trend trader is to enter a trade in the direction of the trend. Reading directional signals from price alone can be difficult and is often misleading because price normally swings in both directions and changes character between periods of low versus high volatility.

The directional movement indicator (also known as the directional movement index - DMI) is a valuable tool for assessing price direction and strength. This indicator was created in 1978 by J. Welles Wilder, who also created the popular relative strength index. DMI tells you when to be long or short.

Source: TDAmeritrade Strategy Desk

Figure 2:

Source: TDAmeritrade Strategy Desk

Figure 4: This is an example of when the price and indicator agree (Point 1), where price makes a new high and +DMI makes a new high, signaling a long entry. There is also an example of divergence (Point 2), where price makes a new high and the +DMI makes a lower high; the result is a trend retracement at Point 3.

DMI Contractions and Expansions

The DMI lines are a good reference for price volatility. Price goes through repeated cycles of volatility in which a trend enters a period of consolidation and then consolidation enters a period of trend.

The primary objective of the trend trader is to enter a trade in the direction of the trend. Reading directional signals from price alone can be difficult and is often misleading because price normally swings in both directions and changes character between periods of low versus high volatility.

The directional movement indicator (also known as the directional movement index - DMI) is a valuable tool for assessing price direction and strength. This indicator was created in 1978 by J. Welles Wilder, who also created the popular relative strength index. DMI tells you when to be long or short.

It is especially useful for trend trading strategies because it differentiates between strong and weak trends, allowing the trader to enter only the strongest trends.

DMI works on all time frames and can be applied to any underlying vehicle (stocks, mutual funds, exchange-traded funds, futures, commodities and currencies).

Here, we'll cover the DMI indicator in detail and show you what information it can reveal to help you achieve better profits. (For background reading, see Momentum And The Relative Strength Index.)

DMI Characteristics

DMI is a moving average of range expansion over a given period (default 14).

DMI Characteristics

DMI is a moving average of range expansion over a given period (default 14).

The positive directional movement indicator (+DMI) measures how strongly price moves upward; the negative directional movement indicator (-DMI) measures how strongly price moves downward.

The two lines reflect the respective strength of the bulls versus the bears. Each DMI is represented by a separate line (Figure 1).

First, look to see which of the two DMI lines is on top. Some short-term traders refer to this as thedominant DMI.

The dominant DMI is stronger and more likely to predict the direction of price. For the buyers and sellers to change dominance, the lines must cross over.

A crossover occurs when the DMI on bottom crosses up through the dominant DMI on top.

A crossover occurs when the DMI on bottom crosses up through the dominant DMI on top.

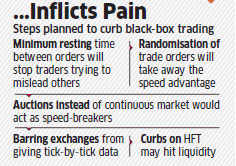

Crossovers may seem like an obvious signal to go long/short, but many short-term traders will wait for other indicators to confirm the entry or exit signals to increase their chances of making a profitable trade.

Crossovers of the DMI lines are often unreliable because they frequently give false signals when volatility is low and late signals when volatility is high.

Think of crossovers as the first indication of apotential change in direction. (For more insight, read the Moving Averages tutorial.)

Source: TDAmeritrade Strategy Desk

Figure 1: The +DMI and -DMI are shown as separate lines. There are several false crossovers ( Point 1) and one crossover at Point 2 that leads to an uptrend with +DMI dominant. Note: The calculations for DMI are complicated and are referenced elsewhere. Also, DMI is normally plotted in the same window with the ADX indicator, which is not shown.

DMI is used to confirm price action (see Figure 2). The +DMI generally moves in sync with price, which means that the +DMI rises when price rises, and it falls when price falls.

Source: TDAmeritrade Strategy Desk

Figure 1: The +DMI and -DMI are shown as separate lines. There are several false crossovers ( Point 1) and one crossover at Point 2 that leads to an uptrend with +DMI dominant. Note: The calculations for DMI are complicated and are referenced elsewhere. Also, DMI is normally plotted in the same window with the ADX indicator, which is not shown.

DMI is used to confirm price action (see Figure 2). The +DMI generally moves in sync with price, which means that the +DMI rises when price rises, and it falls when price falls.

It is important to note that the -DMI behaves in the opposite manner and moves counter-directional to price. The -DMI rises when price falls, and it falls when price rises.

This takes a little getting used to. Just remember that the strength of a price move up or down is always recorded by a peak in the respective DMI line.

Reading directional signals is easy. When the +DMI is dominant and rising, price direction is up.

Reading directional signals is easy. When the +DMI is dominant and rising, price direction is up.

When the -DMI is dominant and rising, price direction is down. But the strength of price must also be considered. DMI strength ranges from a low of 0 to a high of 100.

The higher the DMI value, the stronger the prices swing.

DMI values over 25 mean price is directionally strong. DMI values under 25 mean price is directionally weak.

Source: TDAmeritrade Strategy Desk

Figure 2:

DMI is weak at Point 1 and price is choppy. The +DMI rises strongly above 25 at Point 2 and the uptrend follows. Note how +DMI moves with price at Point 3 and -DMI moves counter-directional to price at Point 4.

DMI Momentum

The great feature of DMI is the ability to see buying and selling pressure at the same time, allowing the dominant force to be determined before entering a trade.

DMI Momentum

The great feature of DMI is the ability to see buying and selling pressure at the same time, allowing the dominant force to be determined before entering a trade.

The strength of a swing high (bulls) is reflected in the +DMI peak, and the strength of a swing low (bears) is seen in the -DMI peaks.

The relative strength of the DMI peaks tells the momentum of price and provides timely signals for trading decisions.

When the buyers are stronger than the sellers, the +DMI peaks will be above 25 and the -DMI peaks will be below 25. This is seen in a strong uptrend. But when the sellers are stronger than the buyers, the -DMI peaks will be above 25 and the +DMI peaks will be below 25. In this case, the trend will be down.

The ability of price to trend depends on continued strength in the dominant DMI.

The ability of price to trend depends on continued strength in the dominant DMI.

A strong uptrend will show a series of rising +DMI peaks that remain above the -DMI for extended periods of time (Figure 3). The opposite is true for strong downtrends.

When both DMI lines are below 25 and moving sideways, there is no dominant force and trend trades are not appropriate.

However, the best trends begin after long periods where the DMI lines cross back and forth under the 25 level.

A low risk trade setup will occur after DMI expands above the 25 level and price penetrates support/resistance.

Source: TDAmeritrade Strategy Desk

Figure 3: The +DMI crosses above 25 at Point 1 and remains above the -DMI as the uptrend develops. Note the absence of any crossover by -DMI during the uptrend. Here, the buyers are strong (+DMI >25) and the sellers are weak (-DMI <25).

DMI Confirmation

DMI lines pivot, or change direction, when price changes direction.

Source: TDAmeritrade Strategy Desk

Figure 3: The +DMI crosses above 25 at Point 1 and remains above the -DMI as the uptrend develops. Note the absence of any crossover by -DMI during the uptrend. Here, the buyers are strong (+DMI >25) and the sellers are weak (-DMI <25).

DMI Confirmation

DMI lines pivot, or change direction, when price changes direction.

An important concept of DMI pivots is they must correlate with structural pivots in price. When price makes a pivot high, the +DMI will make a pivot high. When price makes a pivot low, the -DMI will make a pivot high (remember -DMI moves counter-directional to price).

The correlation between DMI pivots and price pivots is important for reading price momentum. Many short-term traders watch for the price and the indicator to move together in the same direction or times they diverge.

The correlation between DMI pivots and price pivots is important for reading price momentum. Many short-term traders watch for the price and the indicator to move together in the same direction or times they diverge.

One method of confirming an asset's uptrend is to find scenarios when price makes a new pivot high and the +DMI makes a new high. Conversely, a new pivot low combined with a new high on the -DMI is used to confirm a downtrend. This is generally a signal to trade in the direction of the trend or a trend breakout

Divergence, on the other hand is when the DMI and price disagree, or do not confirm one another. An example is when price makes a new high, but the +DMI makes a lower high.

Divergence, on the other hand is when the DMI and price disagree, or do not confirm one another. An example is when price makes a new high, but the +DMI makes a lower high.

Divergence is generally a warning to manage risk because it signals a change of swing strength and commonly precedes a retracement or reversal. (For more on this topic, read Divergences, Momentum And Rate Of Change.)

Source: TDAmeritrade Strategy Desk

Figure 4: This is an example of when the price and indicator agree (Point 1), where price makes a new high and +DMI makes a new high, signaling a long entry. There is also an example of divergence (Point 2), where price makes a new high and the +DMI makes a lower high; the result is a trend retracement at Point 3.

DMI Contractions and Expansions

The DMI lines are a good reference for price volatility. Price goes through repeated cycles of volatility in which a trend enters a period of consolidation and then consolidation enters a period of trend.

When price enters consolidation, the volatility decreases. Buying pressure (demand) and selling pressure (supply) are relatively equal, so the buyers and sellers generally agree on the value of the asset.

Once price has contracted into a narrow range, it will expand as the buyers and sellers no longer agree on price. Supply and demand is no longer in balance and consolidation changes to trend when price breaks below support into a downtrend or above resistance into an uptrend. Volatility increases as price searches for a new agreed value level.

Volatility cycles can be identified by comparing the slopes of the DMI lines that move in opposite directions whenever range expansion or contraction occurs (Figure 4).

Volatility cycles can be identified by comparing the slopes of the DMI lines that move in opposite directions whenever range expansion or contraction occurs (Figure 4).

Many short-term traders will look for periods when the DMI lines move away from one another and volatility increases. The farther the lines separate, the stronger the volatility. Contractions occur when the lines move toward one another and volatility decreases. Contractions precede retracements, consolidations or reversals.

Source: TDAmeritrade Strategy Desk

Figure 5: The first expansion at Point 1 is part of the downtrend. The subsequent contraction at Point 2 leads to a reversal that begins with another expansion at Point 3. The next contraction at Point 4 leads to a consolidation in price.

Bulls, Bears and Trend

DMI peak analysis fits well with trend principles. Before using any indicator, always look at price. Price is trending up when there are higher pivot highs and higher pivot lows.

Source: TDAmeritrade Strategy Desk

Figure 5: The first expansion at Point 1 is part of the downtrend. The subsequent contraction at Point 2 leads to a reversal that begins with another expansion at Point 3. The next contraction at Point 4 leads to a consolidation in price.

Bulls, Bears and Trend

DMI peak analysis fits well with trend principles. Before using any indicator, always look at price. Price is trending up when there are higher pivot highs and higher pivot lows.

When higher highs in price are accompanied by higher highs in +DMI, the trend is intact and the bulls are getting stronger. Lower pivot highs and lower pivot lows signify a downtrend.

When the -DMI peaks make higher highs, the bears are in control and selling pressure is getting stronger.

In any trend, look to the DMI for momentum convergence/divergence; this gives a trader confidence to stay with the trend when price and DMI agree and manage risk when they disagree. The best trading decisions are made on objective signals and not emotion.

Let price and DMI tell you whether to go long or to go short or just stand aside. You can use DMI to gauge the strength of price movement and see periods of high and low volatility. DMI contains a wealth of information that can identify the correct strategy for profit whether you are a bull or bear.

Read more: DMI Points The Way To Profits http://www.investopedia.com/articles/technical/02/050602.asp#ixzz3v2krJMH5

Follow us: Investopedia on Facebook

In any trend, look to the DMI for momentum convergence/divergence; this gives a trader confidence to stay with the trend when price and DMI agree and manage risk when they disagree. The best trading decisions are made on objective signals and not emotion.

Let price and DMI tell you whether to go long or to go short or just stand aside. You can use DMI to gauge the strength of price movement and see periods of high and low volatility. DMI contains a wealth of information that can identify the correct strategy for profit whether you are a bull or bear.

Read more: DMI Points The Way To Profits http://www.investopedia.com/articles/technical/02/050602.asp#ixzz3v2krJMH5

Follow us: Investopedia on Facebook